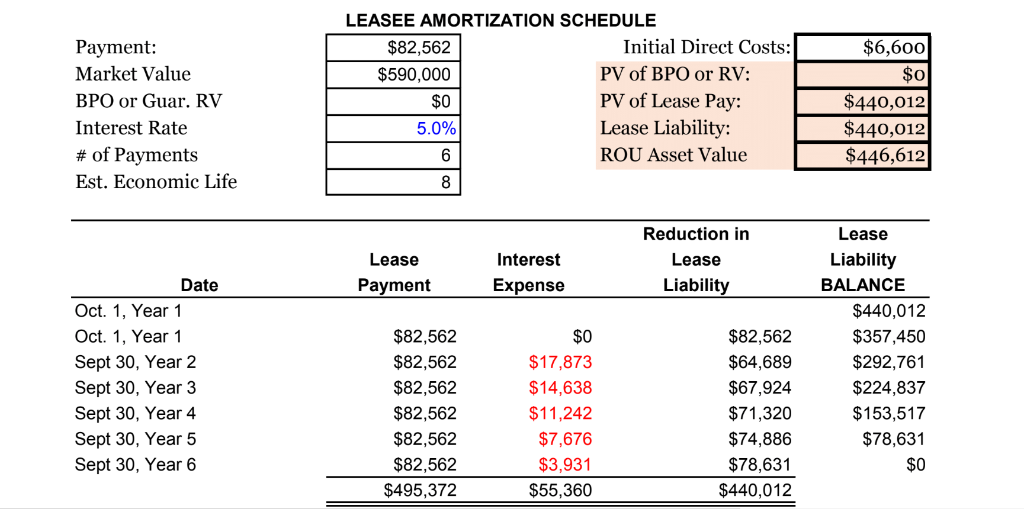

The next sample online lease amortization schedule excel template will present that. The typical scenario is like that.

Lease Modification Accounting For Asc 842 Operating To Operating

Lease Modification Accounting For Asc 842 Operating To Operating

In each case the finance lease accounting journal entries show the debit and credit account together with a brief narrative.

Finance lease amortization schedule. The finance lease accounting journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of finance or capital leases. Finance leases impact the lessee s financial statements. Lease amortization schedule excel template is is free cross platform accommodating easy to use and flexible.

How capital finance lease accounting usually works. Most finance leases are amortized on the basis of constant payments over the lease term and structured according to the individual requirements of the lessee. We have determined the proper lease accounting.

Those features ensure it is the right tool to map your plans for all facets of your lifetime and what s more to follow along with thru on them. The primary reason that leasing generally yields lower monthly payments is that although you are still paying the interest based on the full amount of the loan the capital parts of the payments only have to add up to the difference between the loan and the residual value with r r 1200 the following formula calculates the monthly payment and can be reduced to the loan calculator formula. Calculate the present value of lease payments for a 10 year lease with annual payments of 1 000 with 5 escalations annually paid in advance.

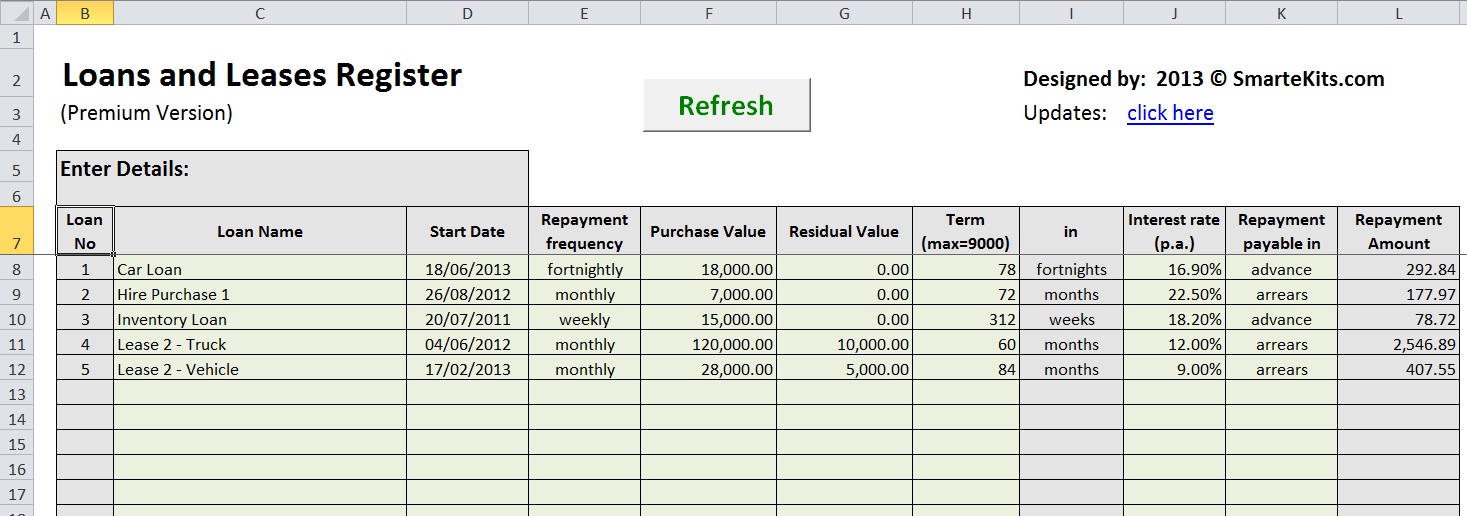

You maintain separate amortization spreadsheets for each lease. But if you want an accurate to the penny amortization schedule then you should spend a minute or two understanding these options. A leased asset s amortization depends on the asset s historical cost estimated economic life residual value and the amortization method chosen.

The following schedule is an image of the lease amortization schedule used to record the journal entries under finance lease accounting. This is a financing capital lease because at least one of the finance lease criteria is met and during the lease the risks and rewards of the asset have been fully transferred. First payment due for leases it may be the same as the loan date.

Loan date the date the money is available. After every period when the lease payment is made there is a reduction in the balance payment to be made as given in the amortization schedule. But if you maintain several dozens of amortization schedules then the task can become quite time consuming.

Here are the steps to follow to calculate the present value of lease payments and the lease liability amortization schedule using excel when the payment amounts are different starting with an example. If the loan is for a vehicle or home it is the loan s closing date. How to record a finance lease we now have all the information we need to record the initial journal entry.

So the initial. As documented above the present value of the minimum lease payments is 15 292 65. In case of just few loans or leases this isn t a big issue.

See about the loan.

Lease Liability Amortization Schedule Calculating It In Excel

Lease Liability Amortization Schedule Calculating It In Excel

What We Found Out Capital Lease Amortization Schedule

Capital Lease Accounting Finance Lease Accounting Example

Capital Lease Accounting Finance Lease Accounting Example

Solved Based On The Following Lease Amortization Schedule Chegg Com

Solved Based On The Following Lease Amortization Schedule Chegg Com

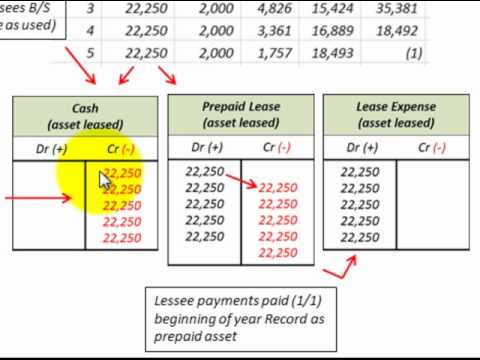

Lease Accounting For Operating Lease Lessor Vs Lessee Recording Of Asset Leased Youtube

Lease Accounting For Operating Lease Lessor Vs Lessee Recording Of Asset Leased Youtube

Leases Chapter 15 Learning Objectives Ppt Download

Leases Chapter 15 Learning Objectives Ppt Download

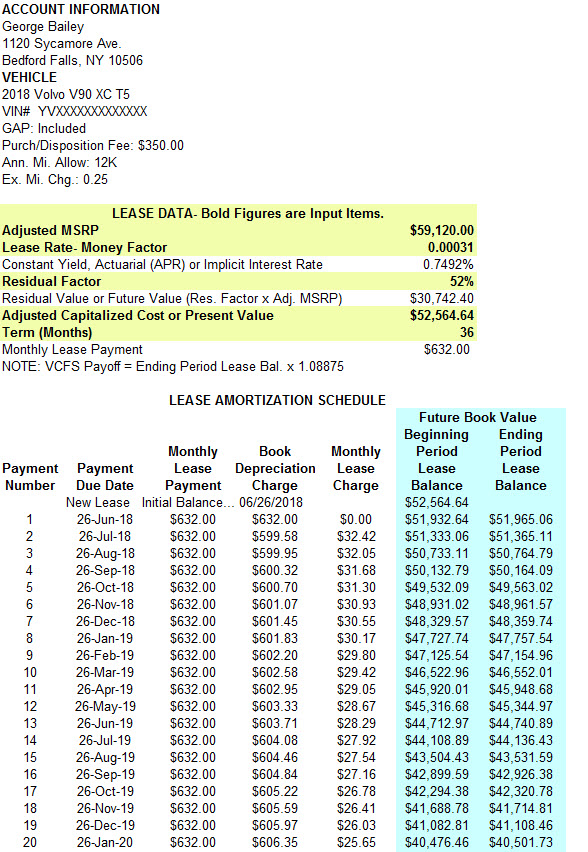

Lease Payoff Know Your Lease Balance And Create A Lease Amortization Schedule Off Ramp Leasehackr Forum

Lease Payoff Know Your Lease Balance And Create A Lease Amortization Schedule Off Ramp Leasehackr Forum

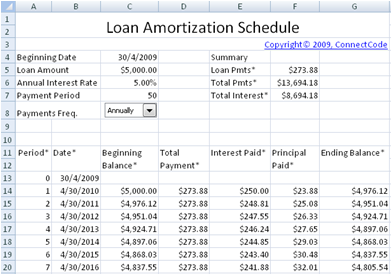

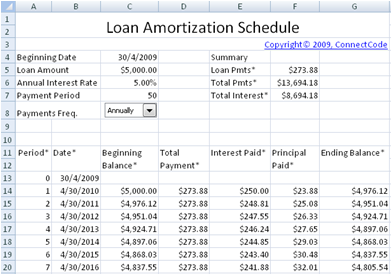

Free Loan Amortization Schedule

Free Loan Amortization Schedule

Solved What Journal Entry Ies Would The Company Need To Chegg Com

Solved What Journal Entry Ies Would The Company Need To Chegg Com

Accounting For Capital Leases Calculator Double Entry Bookkeeping

Accounting For Capital Leases Calculator Double Entry Bookkeeping

Multiple Capital Lease Calculator Excel Amortization Schedule Uncle Finance

Multiple Capital Lease Calculator Excel Amortization Schedule Uncle Finance

0 comments:

Post a Comment