Portfolio variance takes into account the weights and variances of each asset in a. It refers to the total returns of the portfolio over a particular period of time.

Financial Modelling And Business Forecasting Portfolio Management An Investment Portfolio Consisting Of Eight Possible Equity Indic Financial Modeling Investment Portfolio Portfolio Management

Financial Modelling And Business Forecasting Portfolio Management An Investment Portfolio Consisting Of Eight Possible Equity Indic Financial Modeling Investment Portfolio Portfolio Management

Variance analysis is a quite important formula used in portfolio management and other financial and business analysis.

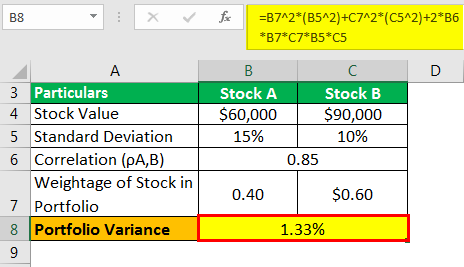

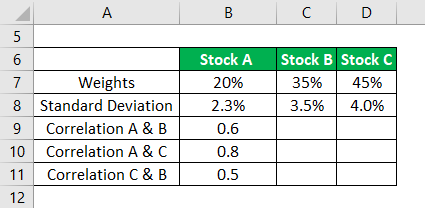

Finance portfolio variance formula. Modern portfolio theory mpt or mean variance analysis is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. Examples of portfolio variance formula with excel template portfolio variance formula. The variance for a portfolio consisting of two assets is calculated using the following formula.

The quantitative formula can be measured as the difference between planned and actual numbers. Covariance in portfolio management covariance applied to a portfolio can help determine what assets to include in the portfolio. In financial terms the variance equation is a formula for comparing the performance of the elements of a portfolio against each other and against the mean.

What is financial modeling financial modeling is performed in excel to forecast a company s financial performance. Portfolio variance is a measure of a portfolio s overall risk and is the portfolio s standard deviation squared. Portfolio variance is a measure of dispersion of returns of a portfolio.

W i the weight of the. These formulas can predict performance relative to each other. Explanation of the portfolio variance formula.

Formula for portfolio variance. The portfolio variance formula of a particular portfolio can be derived by using the following steps. The returns of the portfolio were simply the weighted average of returns of all assets in the portfolio.

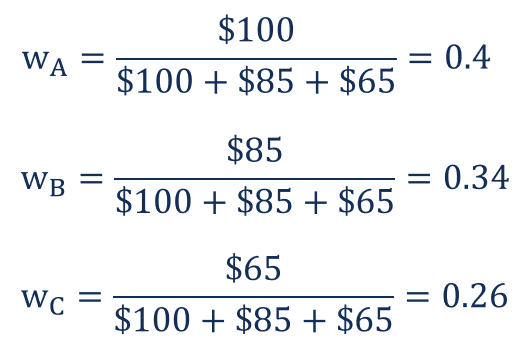

Portfolio variance is a measure of the dispersion of returns of a portfolio it is the aggregate of the actual returns of a given portfolio over a set period of time. Firstly determine the weight of each asset in the overall portfolio and it is calculated by dividing the asset value by the total value of the portfolio. It is a formalization and extension of diversification in investing the idea that owning different kinds of financial assets is less risky than owning only one type.

Overview of what is financial modeling how why to build a model. The portfolio variance formula is used widely in the modern portfolio theory. However the calculation of the risk standard deviation is not the same.

While calculating the variance we also need to consider the covariance between the assets in the portfolio.

Calculating Expected Portfolio Returns And Portfolio Variances Youtube

Calculating Expected Portfolio Returns And Portfolio Variances Youtube

Portfolio Variance Formula Example How To Calculate Portfolio Variance

Portfolio Variance Formula Example How To Calculate Portfolio Variance

To Complete Performance Index Earned Value Management Budget Forecasting Pmbok

To Complete Performance Index Earned Value Management Budget Forecasting Pmbok

Portfolio Variance Definition Formula And Example

Portfolio Variance Definition Formula And Example

How To Easily Calculate Portfolio Variance For Multiple Securities In Excel Youtube

How To Easily Calculate Portfolio Variance For Multiple Securities In Excel Youtube

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gctwwscazhnl23eebjihr6jgsw Yl0a4w8zpvw Usqp Cau

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gctwwscazhnl23eebjihr6jgsw Yl0a4w8zpvw Usqp Cau

Calculating Portfolio Variance Using Variance Covariance Matrix In Excel Risk Contribution Youtube

Calculating Portfolio Variance Using Variance Covariance Matrix In Excel Risk Contribution Youtube

The Kelly Formula For Stock Investing Click On Image Or Press Ctrl For Larger Money Management Investing In Stocks Finances Money

The Kelly Formula For Stock Investing Click On Image Or Press Ctrl For Larger Money Management Investing In Stocks Finances Money

Financial Modelling And Business Forecasting Portfolio Management An Investment Portfolio Consisting Of Eight Possible Equity Indic Financial Modeling Investment Portfolio Portfolio Management

Financial Modelling And Business Forecasting Portfolio Management An Investment Portfolio Consisting Of Eight Possible Equity Indic Financial Modeling Investment Portfolio Portfolio Management

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcsm17fx4cw4k0dxssx Uvq0sjmrwnhc2vyquw Usqp Cau

Https Encrypted Tbn0 Gstatic Com Images Q Tbn And9gcsm17fx4cw4k0dxssx Uvq0sjmrwnhc2vyquw Usqp Cau

Portfolio Variance Formula How To Calculate Portfolio Variance

Portfolio Variance Formula How To Calculate Portfolio Variance

0 comments:

Post a Comment