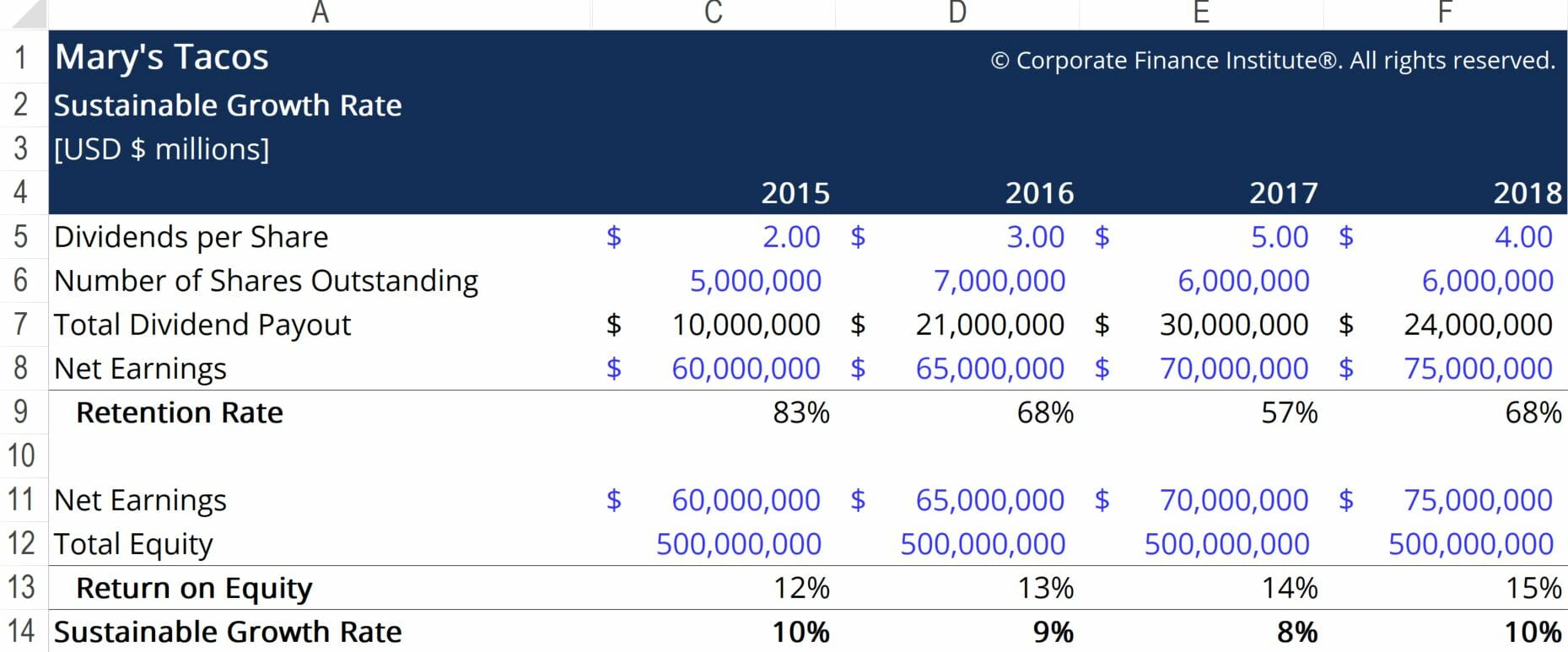

When referencing a company s sustainable growth rate an analyst is discussing the growth in earnings and dividends that can be maintained given a company s roe and its existing capital structure. Whereas r is the retention rate 1 minus the dividend payout ratio.

The Sustainable Growth Rate Sgr Of A Company Venteskraft

The Sustainable Growth Rate Sgr Of A Company Venteskraft

This is the sustainable growth rate this figure represents the return on your business investment you can achieve without issuing new stock investing additional personal funds into equity borrowing more debt or increasing your profit margins.

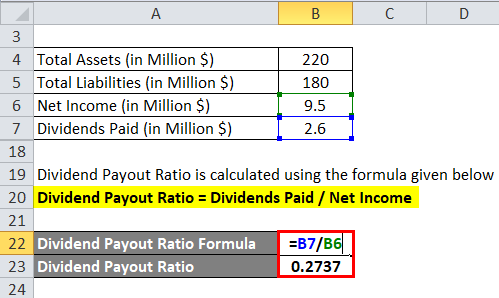

Sustainable growth rate formula finance. The sustainable growth rate may be returned via the following formula. Sustainable growth rate. Sustainable growth rate formula and calculation of the sgr sgr return on equity 1 dividend payout ratio text sgr text return on equity times 1 text dividend payout ratio.

Sustainable growth rate formula 2. However if roe is calculated by dividing net income by current year equity we need to need an alternative formula. Multiply the calculated roe by the retention rate 5 x 90 to calculate the final.

P is the profit margin net profit divided by revenue. Sgr pm 1 d 1 l t pm 1 d 1 l pm is the existing and target profit margin. The sustainable growth rate formula.

One of those factors is the retention rate of earnings or b and the other is the return on equity or roe. It is derived based on two factors. Multiply the earnings retention rate and the roe.

D is the target dividend payout ratio. Hence the roe number is an important determinant of the formula. L is the target total debt to equity ratio.

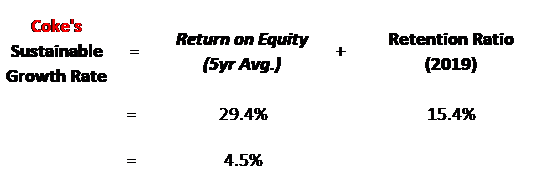

Roe retention ratio. Often referred to as g the sustainable growth rate can be calculated by multiplying a company s earnings retention rate by its return on equity return on equity roe return on equity roe is a measure of a company s profitability that takes a company s annual return net income divided by the value of its total shareholders equity i e. 1 roe retention ratio.

Sustainable growth rate roe retention ratio. What is the sustainable growth rate formula. The second equation to calculate the sustainable growth rate is to multiply the four variables for profit margin asset turnover ratio assets to equity ratio and retention rate.

Sustainable growth rate sgr signifies how much the company can grow sustainably in the future without relying on external capital infusion in the form of debt or equity and is calculated using the return on equity which is the rate of return on the book value of equity and multiplying it by the business retention rate which the proportion of earnings kept back in the business as retained earnings. Sustainable growth rate is calculated using the formula given below sustainable growth rate return on equity roe retention rate sustainable growth rate 0 7276 20 62 sustainable growth rate 15 01. Gsustainable b roe b earnings retention rate 1 dividend payout rate.

The sustainable growth rate formula is pretty straightforward.

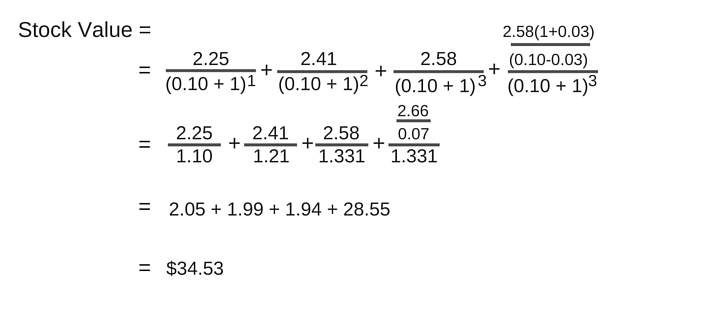

Dividend Growth Rate Definition How To Calculate Example

Dividend Growth Rate Definition How To Calculate Example

Sustainable Growth Rate Sgr Definition

Sustainable Growth Rate Sgr Definition

Dividend Growth Model How To Calculate Stock Intrinsic Value

Dividend Growth Model How To Calculate Stock Intrinsic Value

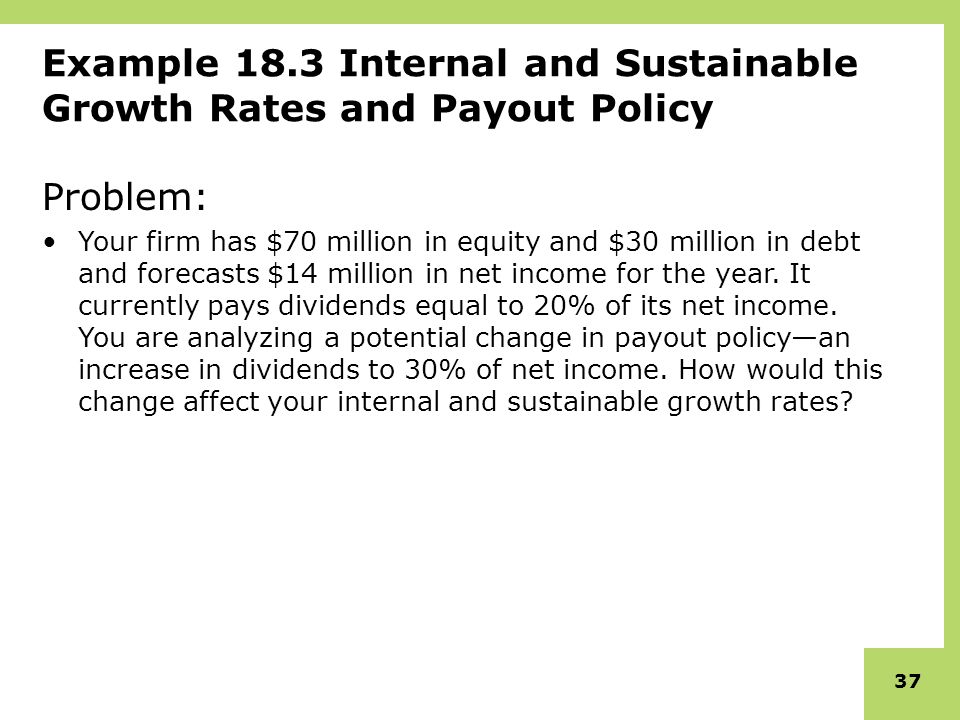

Calculating Growth Internal Growth Rate Vs Sustainable Growth Rate

Calculating Growth Internal Growth Rate Vs Sustainable Growth Rate

Present Value Of Stock With Constant Growth Formula With Calculator

Present Value Of Stock With Constant Growth Formula With Calculator

The Two Stage Dividend Discount Model Dividend Com Dividend Com

The Two Stage Dividend Discount Model Dividend Com Dividend Com

Growth Rate Formula Calculator Examples With Excel Template

Growth Rate Formula Calculator Examples With Excel Template

Sustainable Growth Rate Formula Step By Step Calculation

Sustainable Growth Rate Formula Step By Step Calculation

Financial Modeling And Pro Forma Analysis Ppt Video Online Download

Financial Modeling And Pro Forma Analysis Ppt Video Online Download

Sustainable Growth Rate Formula Calculator Excel Template

Sustainable Growth Rate Formula Calculator Excel Template

Sustainable Growth Rate Definition Example How To Calculate

Sustainable Growth Rate Definition Example How To Calculate

0 comments:

Post a Comment