2 side buy side sell side. 3 role e g risk management investment research e.

Mathematical Finance Seminar What Is Mathematical Finance Other Terms Financial Engineering Quantitative Finance Computational Finance Mathematical Finance Ppt Download

Mathematical Finance Seminar What Is Mathematical Finance Other Terms Financial Engineering Quantitative Finance Computational Finance Mathematical Finance Ppt Download

Presents a multitude of topics relevant to the quantitative finance community by combining the best of the theory with the usefulness of applications written by accomplished teachers and researchers in the field this book presents quantitative finance theory through applications to specific practical problems and comes with accompanying coding techniques in r and matlab and some generic.

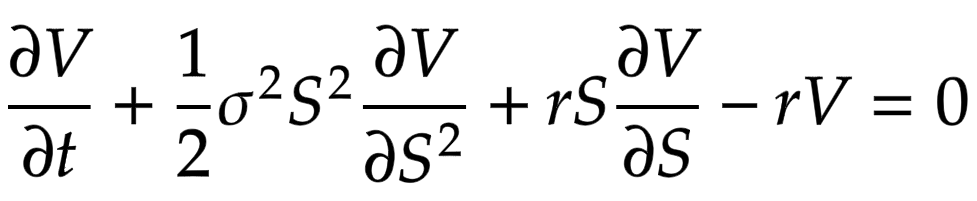

Quantitative finance equations. Quantitative finance for dummies by steve bell dphil. Math for quantitative finance tour the mathematics used to model the chaos of the financial markets. The math used differs somewhat by.

You need to do masters as well. The interest rate also gets a look in. In this course we ll dive into statistical modeling matrices and markov chains and guide you through the powerful mathematics and statistics used to model the chaos of the financial markets.

Quantitative finance means different things to different people. Mathematical finance also known as quantitative finance and financial mathematics is a field of applied mathematics concerned with mathematical modeling of financial markets generally mathematical finance will derive and extend the mathematical or numerical models without necessarily establishing a link to financial theory taking observed market prices as input. Quantitative analysis is the use of mathematical and statistical methods mathematical finance in finance those working in the field are quantitative analysts or in financial jargon a quant quants tend to specialize in specific areas which may include derivative structuring or pricing risk management algorithmic trading and investment management.

The equation is complicated but thankfully mathematicians have solved it for some useful cases such as for european options. It helps you understand quantitative finance with the help of exercises and examples. This book is called an understandable and complete introduction to quantitative finance.

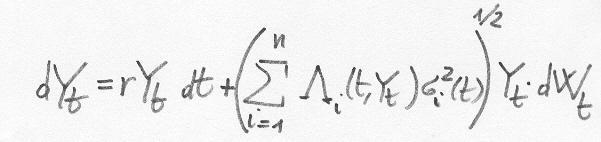

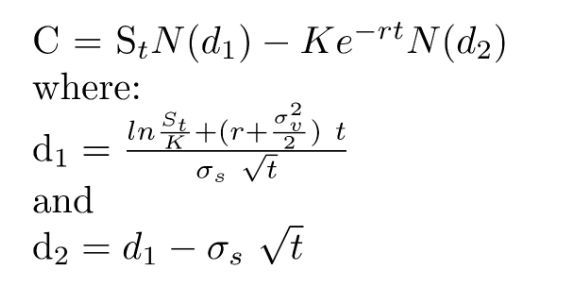

It very smartly covers the core model methods and formulas of quantitative finance. The black scholes equation perhaps the most famous in quantitative finance expresses how the price of an option depends upon the price of the underlying asset and its volatility. 1 asset class e g equities fixed income commodities.

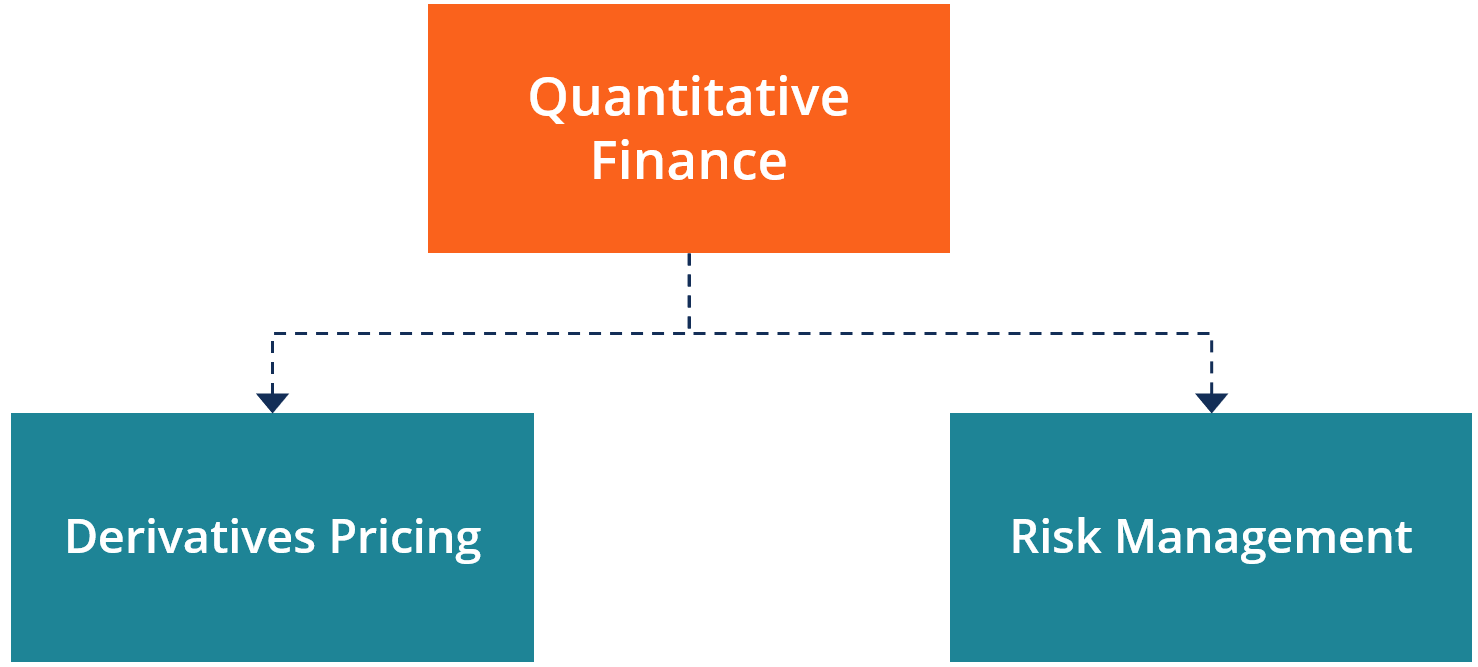

Common examples include 1 the pricing of derivative securities such as options and 2 risk management especially as it relates to portfolio management. Masters degree if you want to become a quantitative financial analyst it s hard to get a job just by doing graduation. Quantitative finance is the use of mathematical models and extremely large datasets to analyze financial markets and securities.

Bachelor s degree in finance or math science is a must.

Pdf Mathematics And Finance The Black Scholes Option Pricing Formula And Beyond

Pdf Mathematics And Finance The Black Scholes Option Pricing Formula And Beyond

The 17 Equations That Changed The World Business Insider

Http Www Newsmth Net Bbsanc Php Path 2fgroups 2fsci Faq 2ffe 2ffe 2fm 1220512433 T0 Ap 253

Https Arxiv Org Pdf 1510 02013

Github Daleroberts Math Finance Cheat Sheet Mathematical Finance Cheat Sheet

Damiano Brigo Mathematical Modeling Mathematical Finance Quantitative Finance Risk Management Stochastic Analysis Stochastic Differential Geometry

Damiano Brigo Mathematical Modeling Mathematical Finance Quantitative Finance Risk Management Stochastic Analysis Stochastic Differential Geometry

What Is Quantitative Finance The Beginning By Abdulaziz Al Ghannami The Startup Medium

What Is Quantitative Finance The Beginning By Abdulaziz Al Ghannami The Startup Medium

Quantitative Finance Definition Components And Quants

Quantitative Finance Definition Components And Quants

Intro To Financial Engineering Who Are These Wizards Who Apply By Luke Posey Towards Data Science

Intro To Financial Engineering Who Are These Wizards Who Apply By Luke Posey Towards Data Science

Https Www Ucl Ac Uk Maths Sites Maths Files Math0088 Mathgm21 Quantitive Computational Finance Pdf

0 comments:

Post a Comment