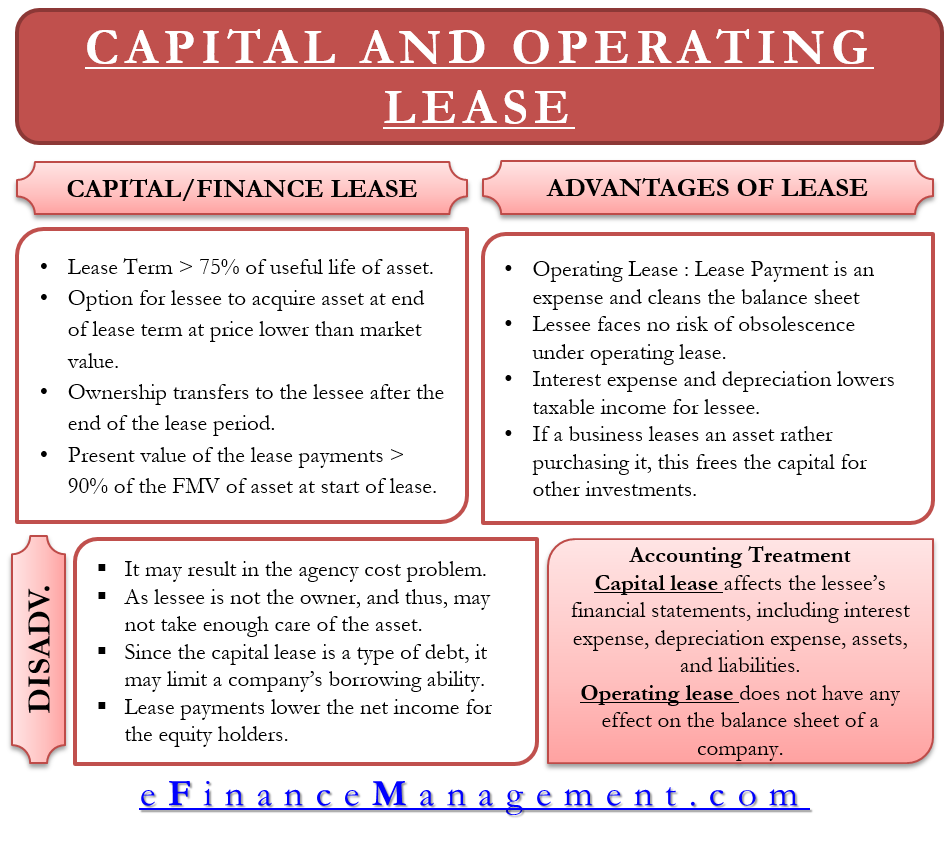

A company would need to perform the finance versus operating lease test which is composed of five parts under topic 842. But in operating lease agreement the ownership of the property is retained during and after the lease term by the lessor.

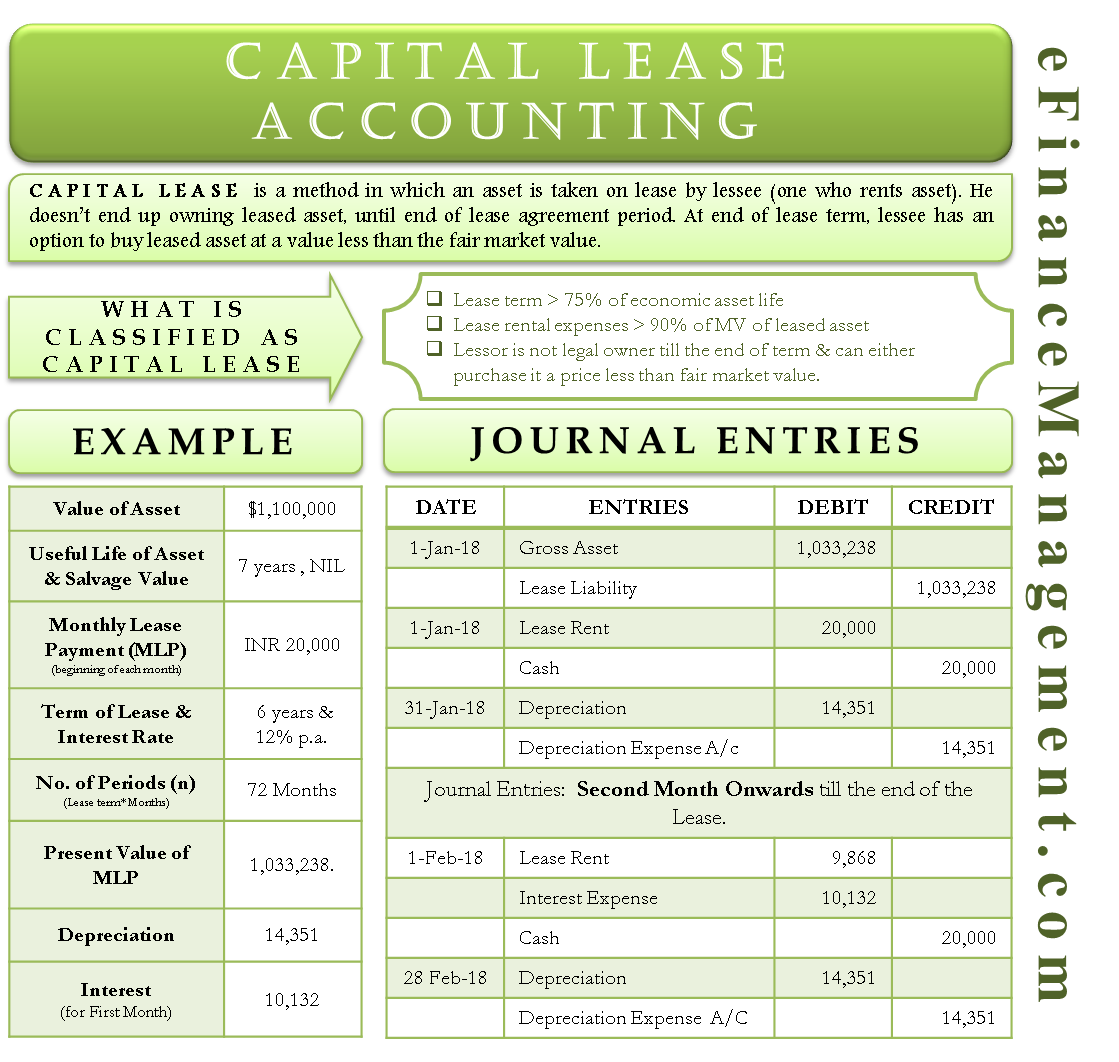

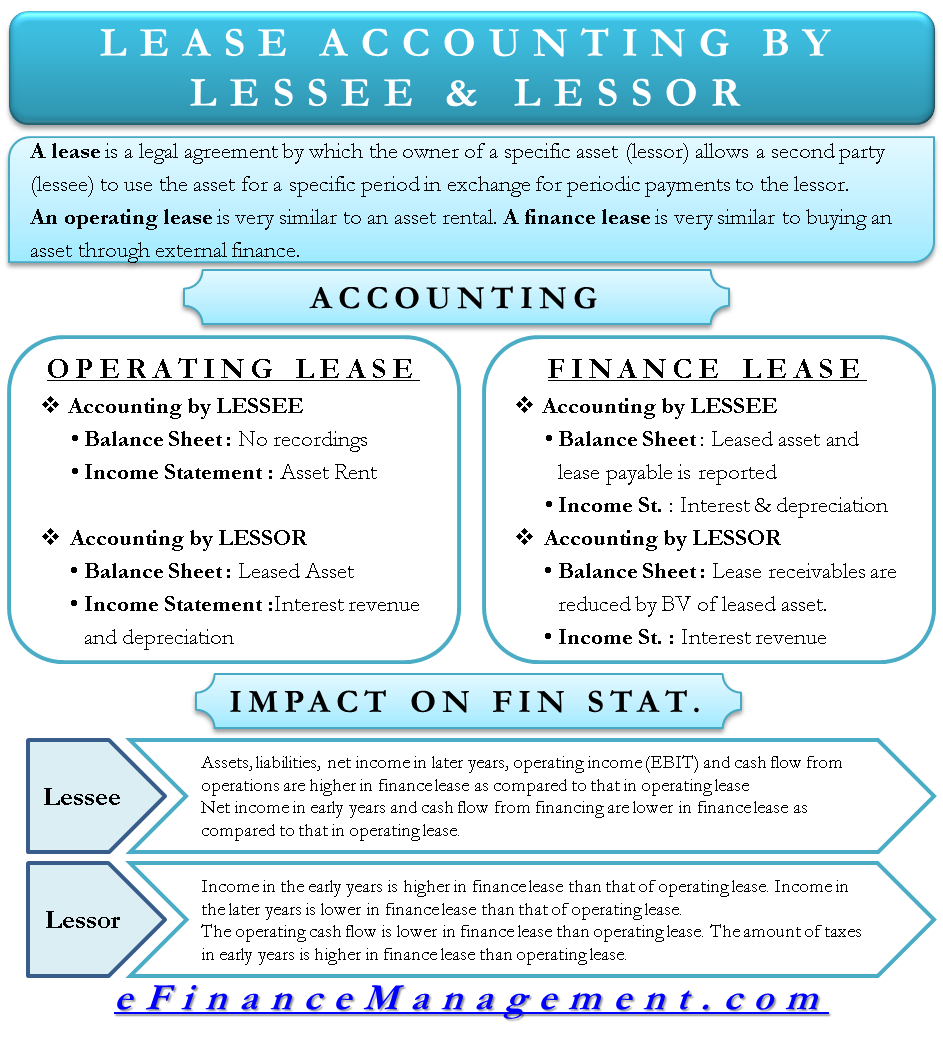

Capital Lease Accounting With Example And Journal Entries

Capital Lease Accounting With Example And Journal Entries

Operating lease on the other hand can be canceled even during the primary period of a contract.

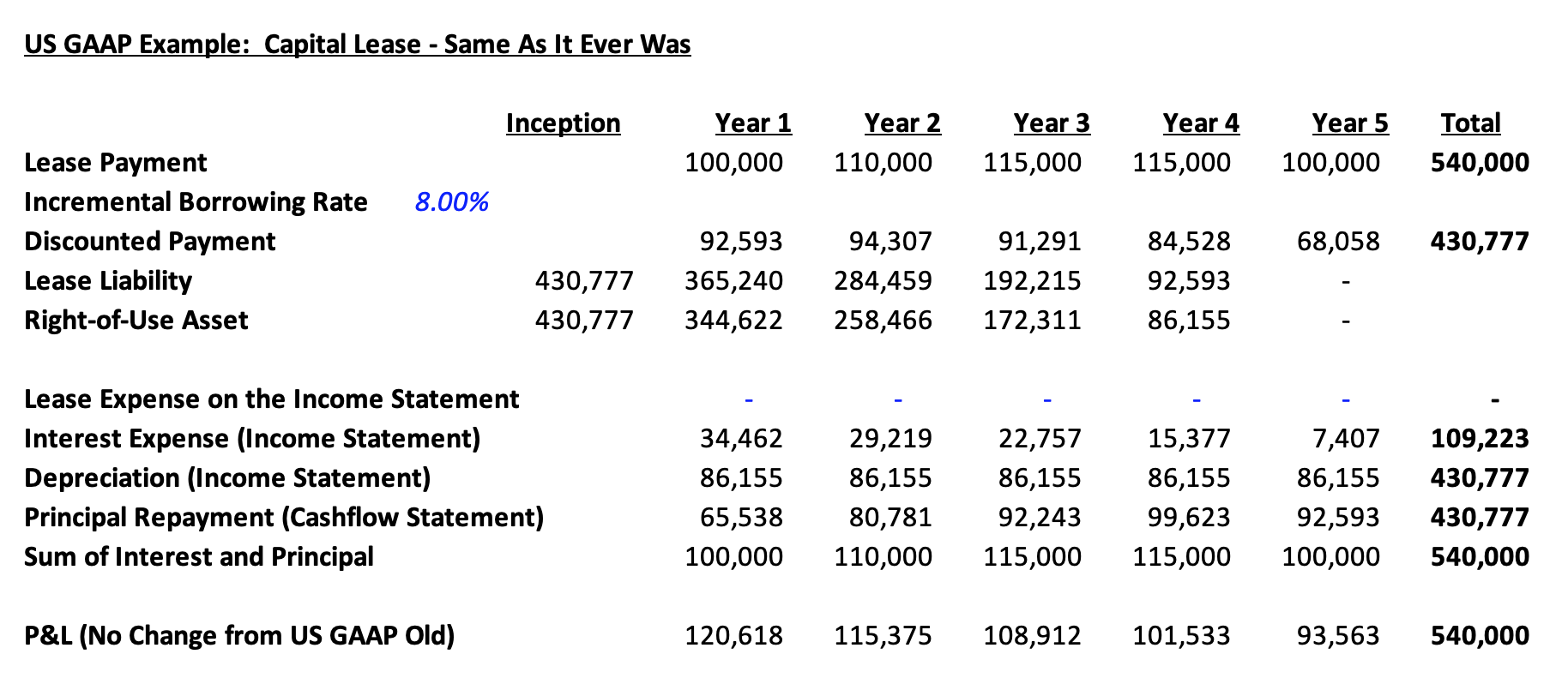

Operating lease vs finance lease example. A finance lease example. One of the provisions of this new standard is that all leases must be recognized on a company s balance sheet. A capital lease or finance lease is treated like an asset on a company s balance sheet while an operating lease is an expense that remains off the balance sheet.

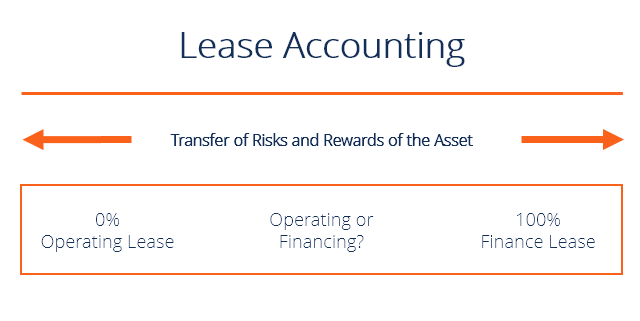

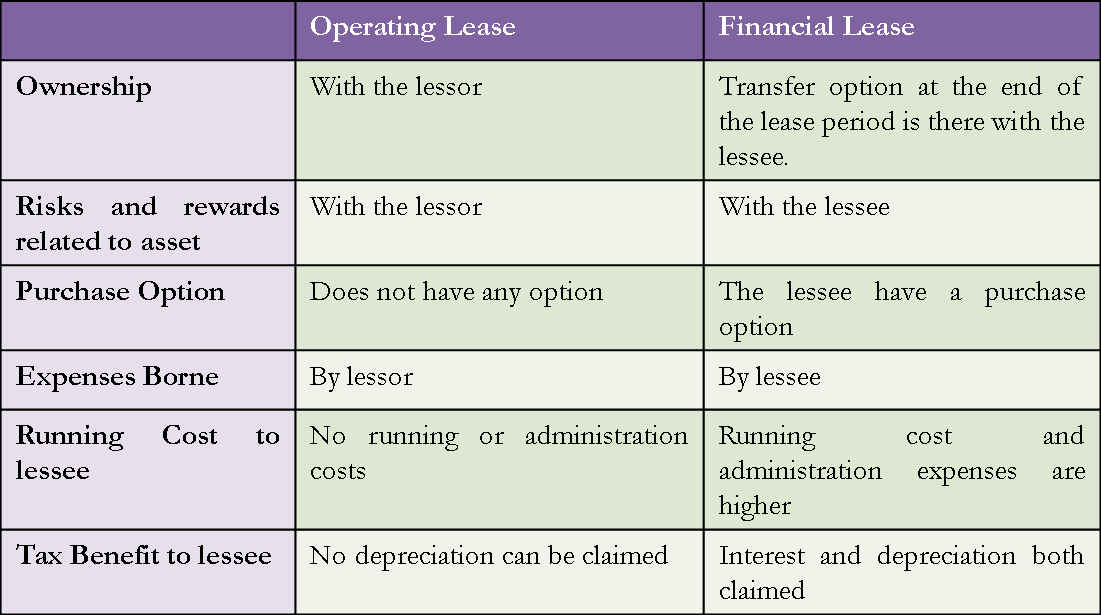

In order to differentiate between the two one must consider how fully the risks and rewards associated with ownership of the asset have been transferred to the lessee from the lessor. Finance lease is commonly used for financing vehicles particularly hard working commercial vehicles where the company wants the benefits of leasing but does not want the responsibility of returning the vehicle to the lessor in a good condition. Operating lease vs financing lease capital lease the two most common types of leases are operating leases and financing leases also called capital leases.

Capital lease vs operating lease. In a financial lease running costs and administration expenses are higher and are born by the lessee. In a finance lease agreement ownership of the property is transferred to the lessee at the end of the lease term.

Operating vs finance leases what s the difference. Leases now follow a single. For example the main difference between a finance lease and an operating lease is financial lease can t be canceled during the initial period of the contract.

Determining finance lease vs. Operating lease under asc 842. In an operating lease no running or administration costs are borne by the lessee including registration repairs etc since this lease gives only the right to use the asset.

A financial lease is a lease where rewards and risk associated with the leased asset gets transferred to the lessee with a transfer of the asset while in operating risk risk and return remain with the lessor. Difference between financial lease vs operating lease. For operating leases asc 842 requires recognition of a right of use rou asset and a corresponding lease liability upon lease commencement.

Under ifrs 16 however there is only one classification finance leases which are classified on the financial statements as long term debt. How do you determine if the lease is a finance lease or an operating lease. If the lease meets any of the following five criteria then it is a finance lease.

Think of a capital lease as more like owning a piece of property and think of an operating lease as more like renting a property. Operating vs finance leases under ifrs 16. Under ias 17 there were two types of leases finance and operating with differing accounting policies and disclosures for each.

Finance lease identification under asc 842.

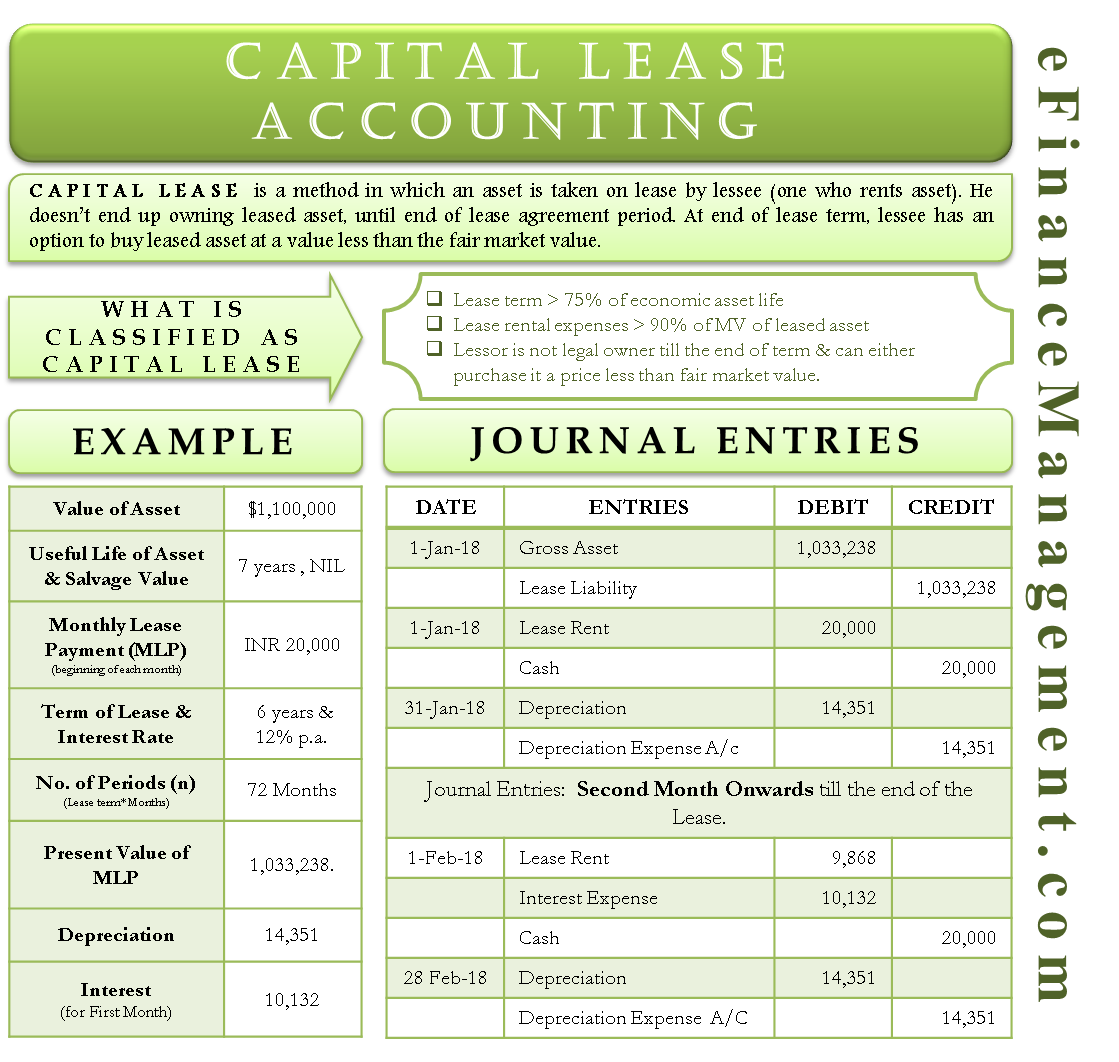

Financial Lease Vs Operating Lease Top 10 Differences

Financial Lease Vs Operating Lease Top 10 Differences

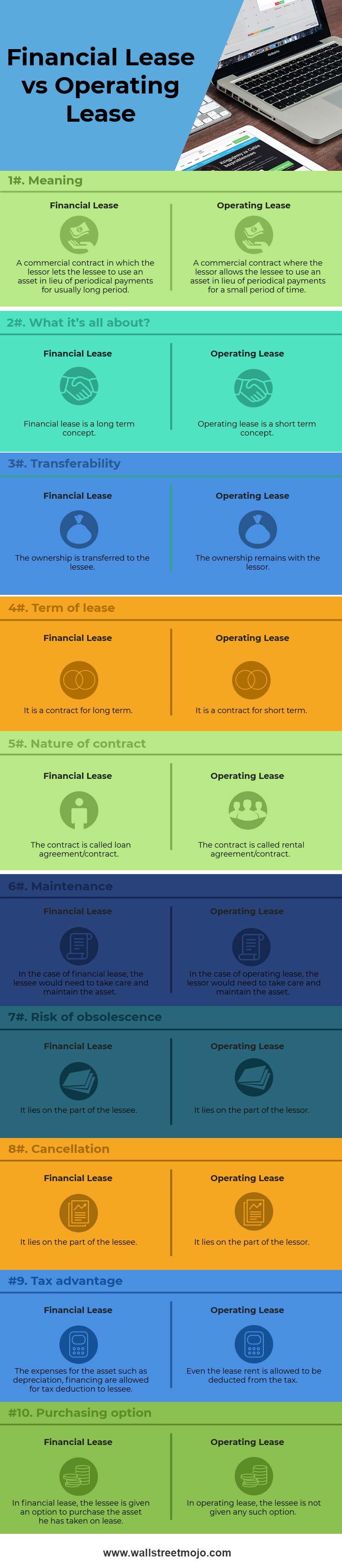

Lease Accounting Treatment By Lessee Lessor Books Ifrs Us Gaap

Lease Accounting Treatment By Lessee Lessor Books Ifrs Us Gaap

Leased Asset Types Accounting Treatment And More

Leased Asset Types Accounting Treatment And More

Accounting For Leases The Marquee Group

Accounting For Leases The Marquee Group

Practical Illustrations Of The New Leasing Standard For Lessees The Cpa Journal

Practical Illustrations Of The New Leasing Standard For Lessees The Cpa Journal

Example Lease Accounting Under Ifrs 16 Youtube

Example Lease Accounting Under Ifrs 16 Youtube

Lease Accounting Operating Vs Financing Leases Examples

Lease Accounting Operating Vs Financing Leases Examples

Capital Lease Vs Operating Lease What You Need To Know In 2020 Finance Lease Financial Modeling Lease

Capital Lease Vs Operating Lease What You Need To Know In 2020 Finance Lease Financial Modeling Lease

Difference Between Operating Versus Financial Capital Lease Efm

Difference Between Operating Versus Financial Capital Lease Efm

Accounting For Leases Under The New Standard Part 1 The Cpa Journal

Accounting For Leases Under The New Standard Part 1 The Cpa Journal

0 comments:

Post a Comment