Leases now follow a single. Operating lease vs financing lease capital lease the two most common types of leases are operating leases and financing leases also called capital leases.

Capital Lease Vs Operating Lease What You Need To Know In 2020 Finance Lease Financial Modeling Lease

Capital Lease Vs Operating Lease What You Need To Know In 2020 Finance Lease Financial Modeling Lease

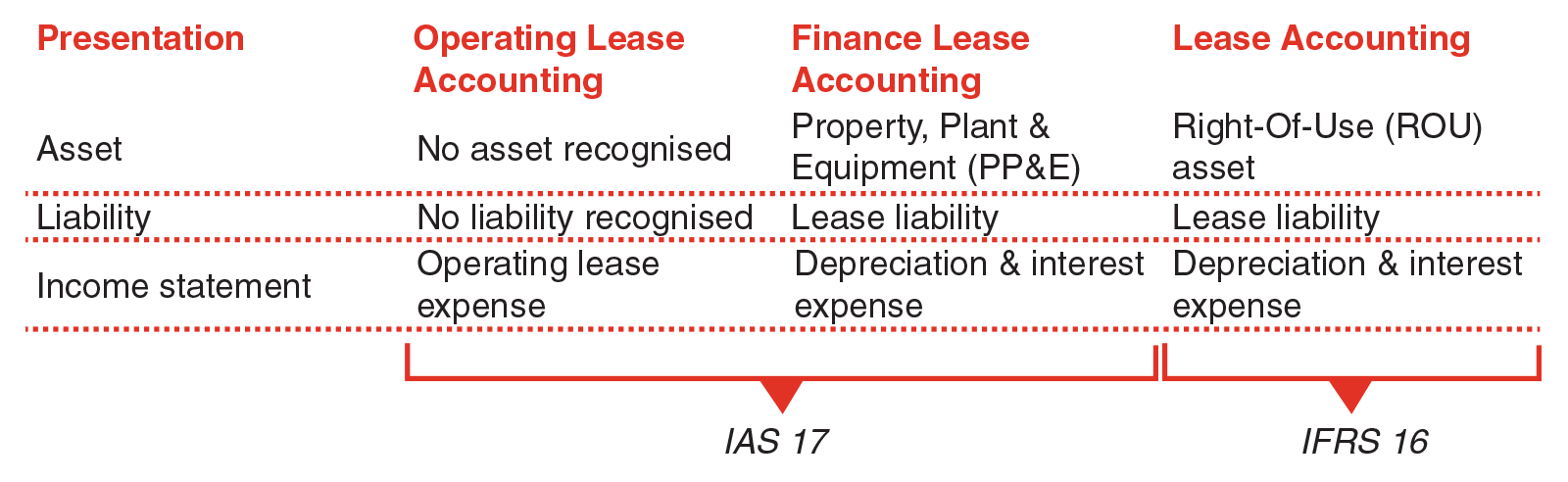

Accordingly under ifrs 16 a lessor will continue to classify its leases as either operating leases or finance leases and to account for those two types of leases differently.

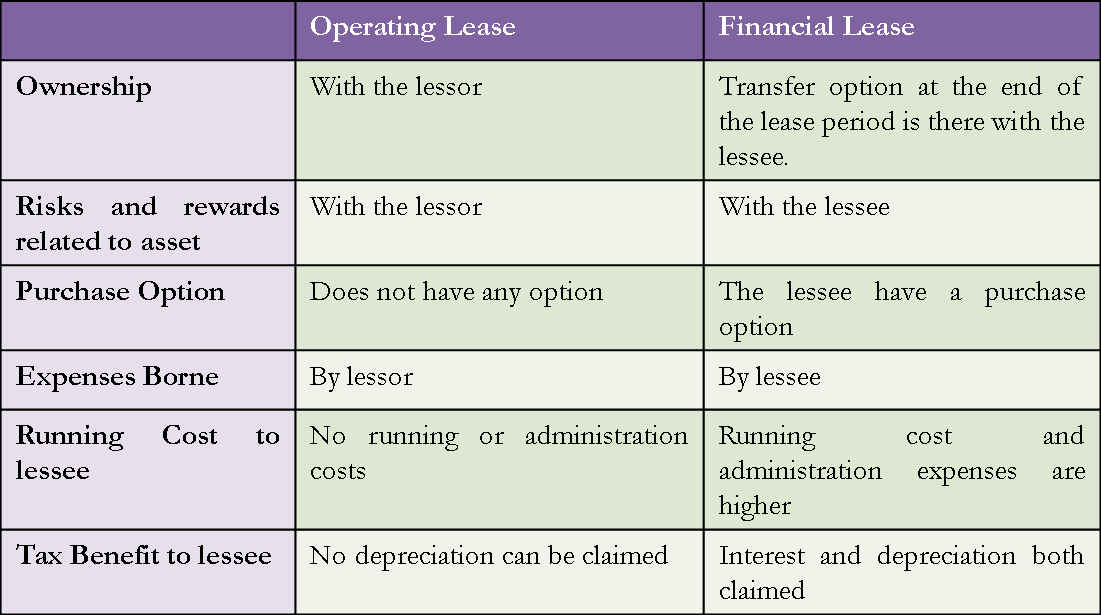

Finance vs operating lease nz. Operating lease comparison table. Over the normal period of an operating lease or finance lease usually 3 years the overall cost of either option works out approximately equal when. In a financial lease there is an asset purchase option given at the end of the contractual period.

For a lessor the finance lease and operating lease distinction remains with the new requirements pretty much carrying forward the old requirements from ias 17. If at the end of the lease period there was a transfer of title to asset to. An operating lease will finance the use of a vehicle without transferring the ownership to you whereas under a finance lease or hire purchase arrangement you will take ownership of the vehicle.

The operating lease provides a tax deduction for rent payments. Ifrs 16 substantially carries forward existing lessor accounting requirements. In order to differentiate between the two one must consider how fully the risks and rewards associated with ownership of the asset have been transferred to the lessee from the lessor.

But in operating lease agreement the ownership of the property is retained during and after the lease term by the lessor. The customer still gets the use of the asset over the agreed contract period in return for rental payments but these payments do not cover the full capital cost of the asset and the customer is not. Finance or operating leases are tax based arrangements whereby generally the right to claim the writing down allowances are held by the lessor and where the lessee is a business making a taxable profit the lessee can set the rental payments against these profits.

Under ifrs 16 however there is only one classification finance leases which are classified on the financial statements as long term debt. Financial lease offers a tax deduction for depreciation finance charges. As opposed to a finance lease a vehicle under an operating lease is always intended to be returned to the lessor at the end of the lease period.

Operating lease versus finance lease are mainly related to who owns the leased asset what accounting and tax treatment are given who bears the expenses and running costs. Under an operating lease there is no such offer. The differences between two basic forms of lease viz.

Such leases will be expensed on a straight line basis over the lease term. Please note that a finance lease and a capital lease are one and the same. Requires contracts that ias 17 classifies as operating leases to be brought onto the balance sheet using the finance lease approach already familiar to us in ias 17.

Operating vs finance leases under ifrs 16. Under ias 17 there were two types of leases finance and operating with differing accounting policies and disclosures for each. In a finance lease agreement ownership of the property is transferred to the lessee at the end of the lease term.

We will be using these terms interchangeably. Operating vs finance leases what s the difference.

Example Lease Accounting Under Ifrs 16 Youtube

Example Lease Accounting Under Ifrs 16 Youtube

Ifrs 16 Set To Have Substantial Impacts Bdo Nz

The Key Differences Between Ifrs 16 And Ias 17 Opal Wave

The Key Differences Between Ifrs 16 And Ias 17 Opal Wave

Financial Lease Vs Operating Lease Top 10 Differences

Financial Lease Vs Operating Lease Top 10 Differences

Difference Between Operating Versus Financial Capital Lease Efm

Difference Between Operating Versus Financial Capital Lease Efm

7 Common Pitfalls To Avoid For Companies Moving To Ifrs 16

7 Common Pitfalls To Avoid For Companies Moving To Ifrs 16

History Of Lease Accounting Why Were The New Standards Introduced Leaseaccelerator

History Of Lease Accounting Why Were The New Standards Introduced Leaseaccelerator

Gst And Finance Leases Classification Method Of Accounting And Treatment Of Residual Value Clause Interpretation Statement Is2450 Cch Iknow New Zealand Tax Accounting

Finance Lease Vs Operating Lease What S The Difference

Finance Lease Vs Operating Lease What S The Difference

0 comments:

Post a Comment