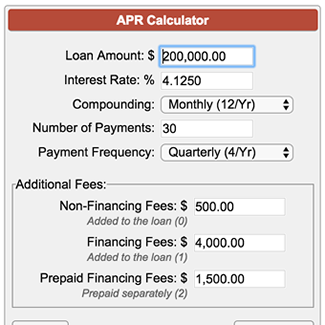

The most common financial formulas that you need are. Amount number of monthly finance finance charge financed payments payment charge per 100 apr 20.

Other formulas used in financial math are related to probability randomness and statistical analysis.

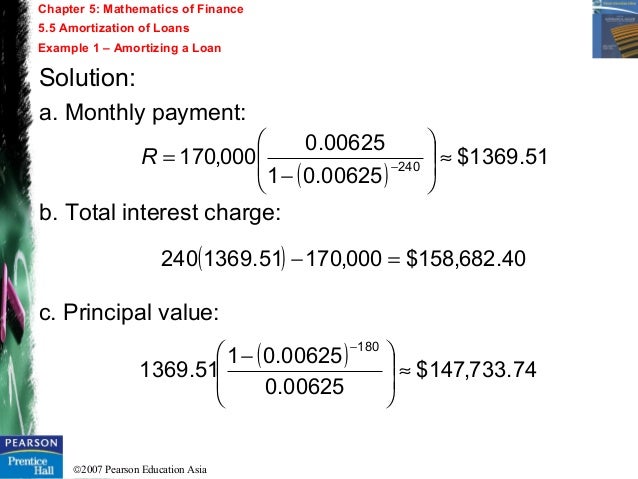

Finance charge formula math. 200 chapter 5 mathematics of finance a deposit of dollars today at a rate of interest p for years produces interest of t r i prt the interest added to the original principal p gives p prt p11 rt2. Financial math has as its foundation many basic finance formulas related to the time value of money. Plug each of the above into formula 2 above.

I p r t simple interest math problems can be used for borrowing or for lending. Part of business math for dummies cheat sheet. The same formulas are used in both cases.

298 44 x 60 15 000 00 2 906 13. Formulas are an important part of business. In addition particulars related to certain financial instruments bonds for example are calculated using derivatives of these basic formulas.

Payments are made at the beginning of each payment period. Add up each day s finance charge to get the monthly finance charge. When loans are involved the future value is often called the maturity value of the loan.

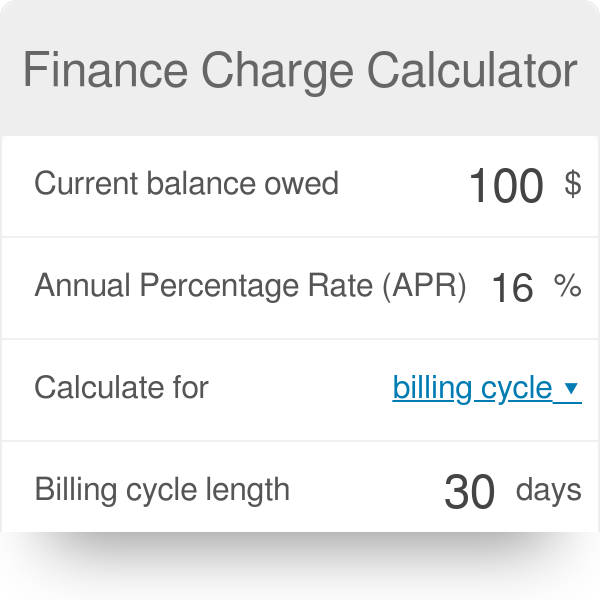

To do this calculation yourself you need to know your exact credit card balance every day of the billing cycle. Advanced math contemporary mathematics for business consumers calculate the finance charge the finance charge per 100 and the annual percentage rate for the following installment loans by using the apr table table 13 1. Finance charges are a type of compensation that allows the lender to make a profit for giving the funds or extending credit to a borrower.

Here is a finance charge formula to calculate your charges. The daily balance method sums your finance charge for each day of the month. When money is borrowed the total amount to be paid back equals the principal borrowed plus the interest charge.

Monthly payment amount x number of payments amount borrowed total amount of finance charges sample calculation. The better way to avoid the financial charges is by not carrying a balance. Then multiply each day s balance by the daily rate apr 365.

The simple interest formula is often abbreviated. To calculate total finance charges to be paid. A formula qualifies as such when it consistently gives you correct results and answers to questions thus providing organization and structure.

Total repayments principal interest. This amount is called the future value of p dollars at an interest rate r for time t in years. For example lease rental payments on real estate.

Time Value Of Money Financial Mathematics Icezen Time Value Of Money Accounting And Finance Finance

Time Value Of Money Financial Mathematics Icezen Time Value Of Money Accounting And Finance Finance

Chapter 5 Mathematics Of Finance

Chapter 5 Mathematics Of Finance

Markup Calculator Math Calculator Calculator How To Find Out

Markup Calculator Math Calculator Calculator How To Find Out

Finding Finance Charge And Apr Youtube

Finding Finance Charge And Apr Youtube

Google Drive Viewer Math Formulas Finance Statistics Math

Google Drive Viewer Math Formulas Finance Statistics Math

Variables And Symbols Used In Financial Formulas Financial Math Formulas Equations

Variables And Symbols Used In Financial Formulas Financial Math Formulas Equations

Financial Math Use The Rule Of 78 For Unearned Interest And Payoff Amount Youtube

Financial Math Use The Rule Of 78 For Unearned Interest And Payoff Amount Youtube

Depreciation Formula Financial Accounting Book Value Straight Lines

Depreciation Formula Financial Accounting Book Value Straight Lines

The Amount Of The Finance Charge That Is Saved When A Loan Is Paid Off Early Is Course Hero

The Amount Of The Finance Charge That Is Saved When A Loan Is Paid Off Early Is Course Hero

Financial Math Average Daily Balance Method For Charging Interest On Open End Credit Credit Cards Youtube

Financial Math Average Daily Balance Method For Charging Interest On Open End Credit Credit Cards Youtube

0 comments:

Post a Comment